Thank you to our friends at MyExpatTaxes for compiling this data! These are all the countries we visit on our group scouting trips, and they shared this info so you could make the best choice about where to visit. Join us for a free Q&A session to learn more! —Jen

If you’ve ever considered retiring abroad, you’re not alone. It’s estimated that well over half a million Americans receive Social Security overseas, a trend fueled by warmer climates, more affordable living, and the promise of a higher quality of life.

Before choosing a destination, it’s essential to understand both your ongoing US tax obligations and how your retirement income may be taxed locally.

With so many Americans making the leap, certain countries stand out for their mix of affordability, lifestyle, and tax advantages. In this article, we’ll look at where expats are heading, from affordable, lesser-known gems to European favorites.

Retire in Ecuador

Ecuador has become one of Latin America’s standout retirement havens for US expats. The country offers an appealing mix of affordability, diverse climates, and striking natural beauty. Retirees can choose between a tropical lifestyle along the coast or mild, spring-like weather in the Andes, all at a cost of living estimated to be about 65% lower than in the United States.

With some 10,000 American expats already living in Ecuador and many retirees, newcomers find it easy to settle into a ready-made community. Add to that high-quality yet affordable healthcare, rich cultural traditions, and a welcoming community of American expats, and it’s easy to see why Ecuador continues to draw retirees from around the world.

Taxes in Ecuador

One of Ecuador’s biggest draws for US retirees is its territorial tax system, which only taxes income earned within the country. For US expats, that means Social Security benefits, pensions, and other foreign income are completely outside local taxation. Tax authorities impose progressive rates on local income, such as rental revenue or business profits, ranging from 0% to 37%.

Additionally, the VAT rate is among the lowest in Latin America, and annual property taxes are modest if you’re considering purchasing property. Ecuador also imposes no wealth tax, so even high-net-worth retirees are not subject to the annual asset taxes levied in some other countries.

Quick Tax Facts

- Wealth Tax: None.

- Social Security & Pensions: Not taxed.

- Foreign Income: Exempt under Ecuador’s territorial system; local income is taxed.

Retire in Ghana

Ghana is emerging as a retirement option for Americans seeking lower costs and a different pace of life. Affordability is a major draw. Housing, food, and daily expenses are far cheaper than in the US, allowing retirees to stretch their savings. The country also offers diverse settings, from Atlantic beaches to rainforest interiors and cooler highland retreats.

Life in Ghana moves more slowly. The culture is renowned for its warmth, with festivals, cuisine, and everyday interactions offering a genuine welcome. Healthcare access continues to expand in major cities, and while it does not yet match Western standards, retirees often find costs far more affordable than in the US.

Taxes in Ghana

Unlike Ecuador, Ghana applies a residency-based tax system. Spending more than 183 days a year in the country makes you a tax resident, and the tax authorities tax residents on worldwide income. Ghana can tax US Social Security benefits, pensions, and other foreign income. Non-residents are taxed only on Ghanaian-source income, typically at a flat rate of 25%, while residents face progressive rates that climb to about 30%.

There is no tax treaty between Ghana and the United States, so there is no exemption or special relief for Social Security or pensions; both remain taxable if you are a Ghanaian tax resident. Ghana imposes no wealth tax.

Quick Tax Facts

- Wealth Tax: None.

- Social Security & Pensions: Taxable if you are a Ghanaian tax resident.

- Foreign Income: Ghana taxes worldwide income; non-residents are taxed only on Ghanaian-source income.

- Tax treaty with US: None, no relief for Social Security or pensions.

Retire in Mexico

Mexico has long been a favorite for American retirees, not only because it’s close to home but also because it offers an appealing balance of cost, convenience, and lifestyle. Affordability is one of the country’s strongest draws; housing, groceries, and transportation cost far less than in the United States.

Many retirees find they can maintain a higher quality of life on the same budget. The country’s diversity means retirees can settle in a seaside town along the Riviera Maya, a colonial city like San Miguel de Allende, or a bustling urban hub like Mexico City.

Healthcare, especially in private hospitals and clinics, is high-quality and much more affordable than in the US. Additionally, the presence of large expat communities helps newcomers integrate smoothly. These factors make Mexico one of the most accessible and rewarding destinations for retirees.

Taxes in Mexico

Mexico uses a residency-based tax system. If you spend more than 183 days a year in the country, you typically become a tax resident and pay taxes on worldwide income. That means US-sourced retirement income can, in principle, be taxable in Mexico.

Fortunately, the US–Mexico tax treaty provides valuable relief, generally exempting Social Security benefits and US employment pensions from taxation in Mexico. Other forms of worldwide income may still be taxable if you are a Mexican tax resident. Mexico does not impose a wealth tax.

Quick Tax Facts

- Wealth Tax: None.

- Social Security & Pensions: Generally only taxed by the US under the US–Mexico tax treaty.

- Foreign Income: Worldwide income is taxable for residents; non-residents are taxed only on locally sourced income.

- Tax treaty with US: Yes, the treaty protects Social Security and US employment pensions.

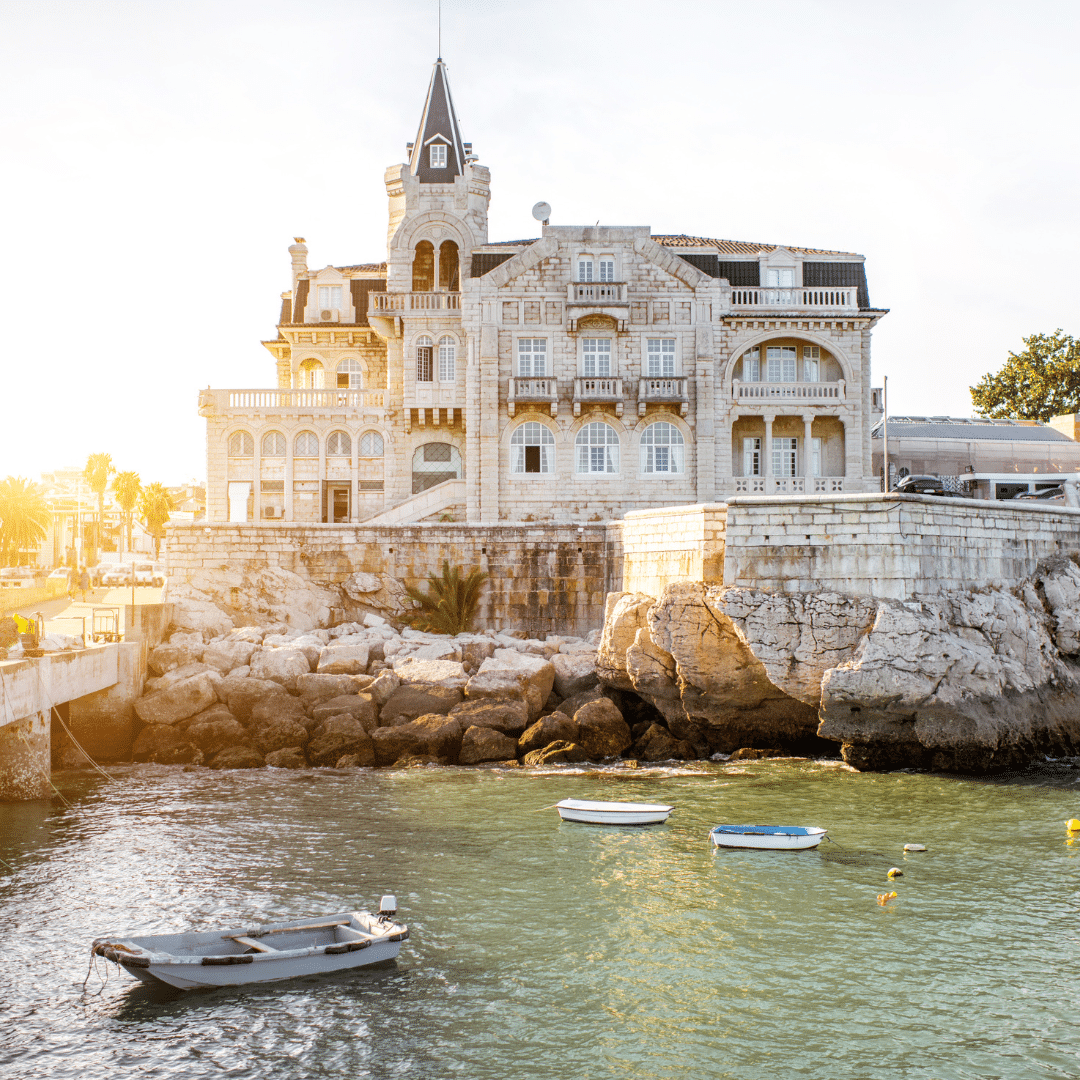

Retire in Portugal

Portugal has become one of Europe’s most popular retirement destinations, offering a mix of sunny weather, striking landscapes, and rich cultural traditions. Retirees can choose between vibrant cities like Lisbon and Porto, the golden beaches of the Algarve, the rural calm of Alentejo, or island living in Madeira.

Portugal is a country known for its fresh seafood, famous custard tarts (pastéis de nata), and cultural hallmarks like fado music. Combined with an affordable cost of living, excellent healthcare, and a high quality of life, Portugal consistently ranks among the best places in the world to retire.

Taxes in Portugal

Portugal applies a residency-based tax system, with progressive rates reaching up to 48%. Residents are taxed on worldwide income, including US Social Security benefits and pensions.

Under the US-Portugal tax treaty, both countries can tax Social Security and retirement income. To avoid double taxation, Portugal must give residents foreign tax credits for any US tax already paid. While Portugal has the right to tax, the credit usually cancels out much or all of it. Portugal does not impose a wealth tax.

Quick Tax Facts

- Wealth Tax: None.

- Social Security & Pensions: Taxable in Portugal, but the US-Portugal tax treaty provides credits that usually offset most or all of the Portuguese liability.

- Foreign Income: Taxable for residents (worldwide income rules apply); foreign tax credits help reduce double taxation.

- Tax treaty with US: Yes — Portugal must give foreign tax credits for any US tax paid on retirement income.

Retire in Spain

For American retirees, Spain offers a blend of sunshine, culture, and value that’s hard to match in Europe. Many American retirees are drawn to the Mediterranean coasts, especially the Costa del Sol and Costa Blanca, where beach towns offer a relaxed pace of life. Others prefer historic cities such as Madrid and Valencia, or island destinations like Majorca. With mild winters, warm summers, and plenty of sunshine, Spain makes it easy to enjoy an active, outdoor lifestyle year-round.

Every day life in Spain is affordable and convenient. The cost of living is significantly lower than in the US, with healthcare consistently ranked among the best in the world. Private coverage remains affordable. Add in Spain’s renowned food and wine, plus a thriving American expat community, and it’s no surprise that more than 40,000 US citizens already call Spain home.

Taxes in Spain

Spain applies a residency-based tax system, with progressive rates reaching up to 47%. Residents who meet the 183-day rule pay taxes on their worldwide income. Non-residents are taxed at flat rates generally 24% on Spanish sourced income.

Under the US–Spain treaty, pensions and other retirement income are taxable in Spain if you are a resident. US Social Security can be taxed by both the US and Spain. To reduce double taxation, you can claim the Foreign Tax Credit on your US return for Spanish tax paid. While Spain generally does not tax US Social Security directly, it may still include it when calculating your overall income bracket, which can increase the tax rate applied to your other income sources.

Spain also has a regional wealth tax. In some regions, such as Madrid, authorities have eliminated the tax, while in others, like Catalonia or Valencia, they apply it above certain thresholds.

Generally, the first €700,000 of net assets per person is exempt (plus an additional allowance for a primary residence). Rates then progress from around 0.2% to 3.5% depending on the region and the total value of assets. Importantly, the full value of US retirement accounts like IRAs counts toward the Wealth Tax threshold in Spain because the calculation includes the gross account value.

Quick Tax Facts

- Wealth Tax: Progressive rates from 0.2% to 3.5%, generally applied above €700,000 per person, with an additional exemption for a primary residence. Thresholds and rates vary by region.

- Social Security & Pensions: Pensions and Social Security are taxable in Spain if you meet residency requirements.

- Foreign Income: Taxable for residents (worldwide income).

- Tax treaty with US: Yes, Spain has taxing rights on pensions for residents, but the savings clause lets the US tax them as though the treaty did not exist. Double taxation can be avoided by claiming the Foreign Tax Credit.

US Taxes

Understanding your US tax obligations is non-negotiable. Americans are taxed on their worldwide income, no matter where they live, as long as they meet the minimum filing thresholds. Fortunately, for expats, there are a few key provisions that can reduce the impact of double taxation:

- Foreign Tax Credit (FTC): Lets you claim a dollar-for-dollar credit for income taxes you’ve already paid to another country. This is especially important for income not covered by other exclusions, like pensions, investment income, or rental income.

- Foreign Earned Income Exclusion (FEIE): Allows qualifying expats to exclude up to $130,000 of foreign earned income in 2025. This applies only to wages or self-employment income, not passive income such as pensions, Social Security, or investment returns, which would instead rely on the FTC for relief.

- Tax Treaties: The US has treaties with many countries that can often help reduce double taxation on pensions, Social Security, and other income.

Withdrawals from Roth IRAs and Roth 401(k)s are typically tax free, provided you meet the rules for qualified distributions. Social Security benefits remain taxable under US law, with up to 85% of benefits included in taxable income depending on your total income level.

IRS Reporting Obligations

In addition to filing your annual US tax return, expats may also face extra reporting requirements for foreign accounts and assets:

- FBAR (Foreign Bank Account Report): If the total value of your foreign financial accounts combined exceeds $10,000 at any point during the year, you must file FinCEN Form 114 electronically.

- Form 8938 (FATCA): Expats with foreign assets above certain thresholds (starting at $200,000 for single filers living abroad) must also file Form 8938 alongside their tax return.

These forms serve purely informational purposes; no tax is owed on them. However, penalties for not reporting are hefty and apply even if you were unaware of the requirement.

Planning Your Retirement Abroad

Choosing the right destination depends on your personal goals. Each country offers its own mix of benefits and tax rules.

Balancing US tax obligations with a new country’s rules is rarely straightforward. Each country has its own approach to taxing pensions, investments, and Social Security, and mistakes can lead to double taxation or missed opportunities for relief. Working with a professional who understands both US and international tax systems can make all the difference.

With tailored guidance, you can simplify your filings, protect your benefits, and feel confident that your retirement income is managed correctly across borders.